Struggling to break free from the cycle of debt each month? You’re not alone. Many people do their best to plan their finances, only to find themselves overspending or forgetting bills. That’s where budgeting tools to help you stop accumulating debt can make a major difference especially when they’re tailored to your lifestyle.

These 12 unique tools go beyond the typical budget apps. Whether you’re a visual learner, a couple managing finances together, or someone who prefers automation, there’s a monthly personal budget tool that stops debt waiting to work for you.

Why You Keep Accumulating Debt—Even With a Budget

Traditional budgeting often fails because it doesn’t match real-life behavior. Maybe you create a budget at the start of the month but never track your spending. Or perhaps unexpected bills throw you off course. Emotional spending, lack of automation, and rigid tools are also big culprits.

To truly stop accumulating debt monthly, you need budgeting tools that are:

- Flexible enough to handle life’s ups and downs

- Easy to use regularly

- Encouraging, not overwhelming

That’s why using a monthly personal budget tool that stops debt can completely change your financial direction.

What Makes a Budgeting Tool “Unique”?

Not every budgeting system is created equal. A unique budgeting tool:

- Tackles a specific financial pain point

- Fits your preferred learning and organizing style

- Offers real-time insights and automation

- Encourages small wins to build financial confidence

All the tools listed below are hand-picked for their practicality, ease of use, and alignment with the goal of debt-free living.

1. You Need A Budget (YNAB)

YNAB is one of the best tools for zero-based budgeting. Every dollar you earn is assigned a job whether it’s going to bills, savings, or debt. This method ensures you’re proactive rather than reactive.

If you want a budgeting tools to help you stop accumulating debt YNAB offers a proven system. It also syncs with your bank and provides spending insights so you can adjust in real time.

2. Goodbudget (Envelope App)

If you’re drawn to the classic envelope budgeting method, Goodbudget is a great digital alternative. It lets you allocate funds to different spending categories like groceries, entertainment, or rent.

This tool shines when you’re trying to prevent overspending. With its envelope-style setup, it becomes a monthly personal budget tool that stops debt by helping you spend intentionally.

3. Tiller Money

Tiller connects to your bank accounts and fills Google Sheets with your transactions. It’s ideal for people who love spreadsheets but hate entering data manually.

With Tiller, you gain full customization of your budget and can create detailed debt payoff plans. It’s an excellent monthly personal budget tool that stops debt through visibility and habit tracking.

4. Budget Binder with Debt Trackers

Sometimes, going analog works better. A budget binder helps you lay everything out physically your income, bills, savings goals, and debt payoff progress.

Many people find motivation in filling out colorful trackers and visually watching debt decrease. It’s a hands-on, motivational budgeting tools to help you stop accumulating debt, especially for visual learners.

5. Rocket Money

Rocket Money scans your subscriptions and spending to find areas where you’re losing money like forgotten gym memberships or streaming services.

It’s a powerful tool that helps you stop accumulating debt without much effort. Rocket Money is one of the smartest budgeting tools to help you stop accumulating debt by simply identifying waste.

6. Sinking Funds Wallet System

A cash-stuffing approach, the sinking funds wallet method allows you to prepare for future expenses like holidays, car maintenance, or school fees.

By planning for irregular costs, you’re less likely to rely on credit cards. This proactive technique is a tactile monthly personal budget tool that stops debt with strong community support on social media platforms like TikTok.

7. Zeta Money Manager (For Couples)

Money conversations in relationships can be tough. Zeta allows you to manage shared and individual budgets, track goals together, and stay transparent without stress.

It’s a fantastic budgeting tools to help you stop accumulating debt for couples trying to align their financial habits and responsibilities.

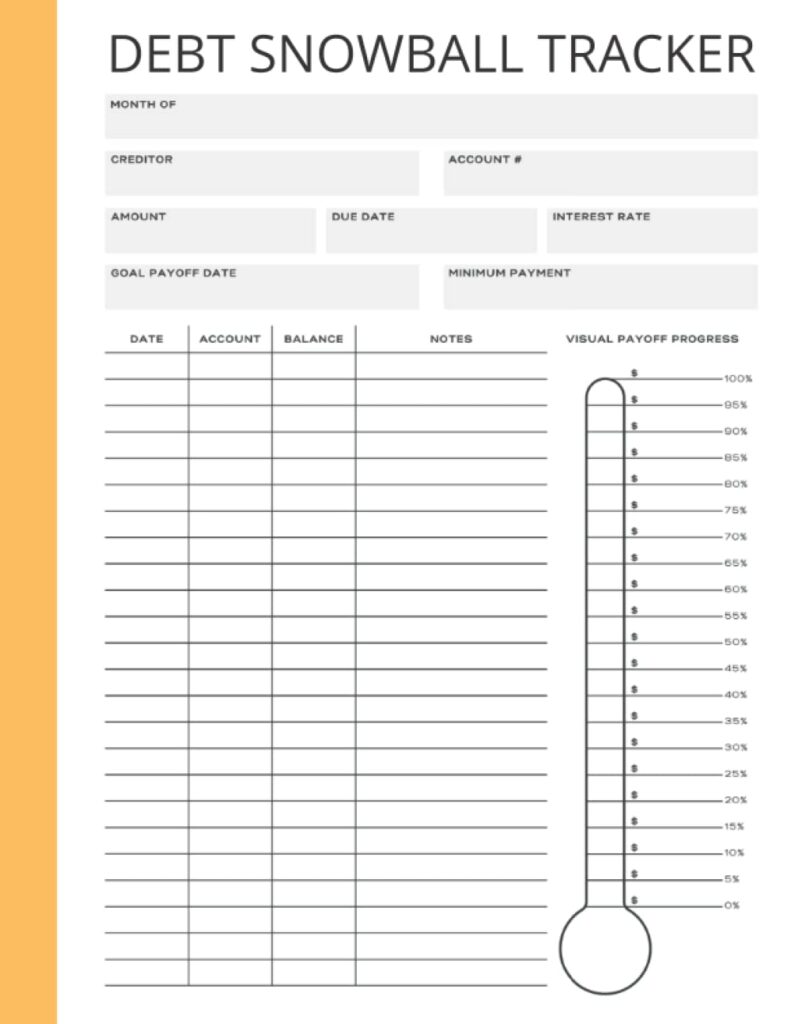

8. Debt Snowball Tracker App

This app helps you visualize and track your progress as you pay off debts from smallest to largest. Seeing loans disappear gives you a strong sense of momentum.

It’s a psychologically powerful monthly personal budget tool that stops debt, especially for those motivated by results.

9. Budget Calendar Tools (Like CalendarBudget)

A calendar-based tool gives a day-by-day visual of your bills, income, and spending. You can plan around paydays and avoid surprise overdrafts.

If you’re trying to stay on top of timing-related debt traps (like missed due dates), this calendar method becomes a smart budgeting tools to help you stop accumulating debt

10. Qube Money

Qube is a digital banking system that brings the envelope method to your debit card. Each spending category becomes a digital “qube” you fund in advance.

It requires intentional spending and lets you approve transactions in real time. That’s what makes it a fantastic monthly personal budget tool that stops debt for impulse spenders.

11. PocketGuard

This app calculates your “left to spend” amount after bills and savings, so you always know your safe limit.

It takes the mental load off budgeting and gives a clear green or red light to purchases. PocketGuard is a simplified yet smart monthly personal budget tool that stops debt by preventing overspending.

12. Printable Debt-Free Charts

If you love visuals, this is for you. Whether it’s coloring in a chart or marking a milestone, printable trackers give you tangible motivation.

These are especially useful for families or kids learning about money. They’re a fun and affordable budgeting tools to help you stop accumulating debt by turning finance into a game.

How to Choose the Best Tool for You

Not sure where to start? Ask yourself:

- Do I prefer digital or physical tools?

- Do I want automation or hands-on control?

- Am I budgeting solo or with a partner?

- Do I need accountability or privacy?

Test one or two tools for a full month. Remember: even the best budgeting tools to help you stop accumulating debt won’t work if you don’t use them consistently.

Tips to Stay Out of Debt Every Month

- Set up auto-pay for bills to avoid late fees

- Use a debt tracker to stay motivated

- Start small: track just three spending categories

- Build a mini emergency fund to cover surprises

- Celebrate non-spending days or budget wins

Most importantly, be patient. Becoming debt-free isn’t instant but the right monthly personal budget tool that stops debt makes it achievable.

Final Thoughts

Budgeting doesn’t have to be a boring or frustrating task. With the right tools, you can feel more confident, stay on track, and finally stop watching your debt pile up month after month.

So, which budgeting tools to help you stop accumulating debt will you try first?

Your journey to debt-free living starts today with just one smart choice.

FAQ: Budgeting Tools to Help You Stop Accumulating Debt Monthly

Q1: What is the most effective monthly personal budget tool that stops debt for beginners?

For beginners, YNAB (You Need A Budget) is highly effective. It walks you through setting up a zero-based budget, helps you assign every dollar a purpose, and provides live workshops and support. It’s one of the most intuitive budgeting tools to help you stop accumulating debt, especially if you’re new to financial planning.

Q2: Can I use budgeting tools if I prefer using cash instead of cards?

Yes! The cash envelope method and sinking funds wallet system are perfect for cash users. These systems help you categorize spending and prevent overspending without needing any digital setup. A printable budget binder can also serve as a physical monthly personal budget tool that stops debt.

Q3: Are budgeting apps safe to connect to my bank account?

Most top-rated budgeting apps like Tiller, PocketGuard, and YNAB use bank-level encryption and read-only connections. That means they can view your transactions but can’t move money. Always check the app’s privacy and security settings before linking your account.

Q4: How long does it take to see results using a budgeting tool?

If used consistently, many users notice a difference in 30 days. Within three months, people often report reduced overdrafts, better bill payment habits, and early debt reduction. The key is choosing a budgeting tools to help you stop accumulating debt and sticking with it.

Q5: Can I use more than one budgeting tool at once?

Yes, but it’s best to avoid overwhelming yourself. Many users pair one primary budgeting app (like Rocket Money or Zeta) with a secondary visual tracker, such as printable debt charts. Just make sure your tools complement each other and don’t duplicate effort.